Many people dream of owning a slice of paradise and buying property in the Caribbean. Whether it is for retirement living, vacation destination or an income earner, here are ten tips to help you have a smooth and enjoyable experience of buying in the Caribbean…. and we are speaking from first hand experience – so we can help you!

1. Do your research

Your one day cruise ship stop or your five-day vacation may have triggered the urge to move to the Caribbean but take a short step back. There are some basics of where to start. For example, if you’re buying for investment, i.e. you plan to rent the home, be sure that the property is close to amenities and facilities such as shops or the beach. If you’re looking a property for retirement, find out if adequate health and support services are available. Look beyond the honeymoon experience to find out how developed is the infrastructure (roads, water, electricity, phone and internet). Issues like safety and emergency response should also be taken into account. Is the island the place for you?

2. Secure a lender early

Before you go searching for property you should be aware of how the purchase will be financed. If you intend to secure a mortgage, seek pre-approval from your lender before you go house hunting. Some Caribbean islands require that you have all the funds needs to purchase. Whereas in some location, you can get a mortgage. Getting a mortgage from a Caribbean lender varies only slightly from the institutions in your home country, as you will still need to show documentary evidence of your ability to repay the loan. You can check out our mortgage calculator on this website to help. This calculator is based for Sint Maarten.

3. Hire a ‘real’ real estate agent

Many real estate agents working in the Caribbean are usually well versed on the property laws and regulations that vary from island to island. They will be able to help you find the dream property and steer you to the shortcuts to bypass red tape that can frustrate the process. A good real estate agent will have in-depth knowledge of the island, is well connected and able to recommend you to other professionals and services you will need to complete the purchase. However, be wary, many that call them selves agents are unexperienced and without qualifications as many islands do not require licensing. A good test is for you to ask the sales person if they are actually a “Realtor”. The term Realtor is a trademarked name only allowed for those with licenses issued in Canada or United States. If they look at you puzzled when you ask, chances are they have no idea why you are asking. And yes, we can use the term realtor 🙂 Another great test is to call a few agents (and email) see who gets back to you first. That is a good first step.

4. Hire an attorney or Notary

When you decide on the property you will need to make an offer to purchase. However, the laws surrounding the purchase of property by overseas residents vary in the Caribbean, so it is prudent to have an attorney to help you interpret these laws. When choosing an attorney or Notary, try and get a referral from a fellow expat who has gone through the process and currently lives on island. On Sint Maarten specifically, land transfers are handled by Notaries only. Lawyers can be used for sales of real estate that are sold along with the holding company Ltd.

5. Make sure you are eligible to purchase property

Some countries like St. Lucia require you to be on the island to sign the conveyance documents for purchasing property. In Jamaica, you must have a unique taxpayer registration number issued by the Tax Administration Department before the purchase can proceed. Other islands have mandatory requirements for overseas property buyers. In Sint Maarten almost everyone is eligible to buy and you can close from off-shore with a POA (power of attorney).

6. Get an appraisal/surveyor’s report

You may need or want a valuation and survey report. The valuation should provide information about the property to determine its true market value. The survey report will determine the legal boundaries of the property and whether there are any encroachments. This is mandatory if applying for a mortgage on St . Maarten.

7. Prepare for the true cost of buying

Buying property does not only involve the cost of the land. There are attorney’s fees, real estate commission fees, the cost of valuation and survey, land transfer taxes and other fees that some islands require upfront. For example, some countries ask you to apply for a residency permit or pay a non-national fee before you can purchase land. On Dutch Sint Maarten add 6% to the sell price, and the French side of Saint Martin, add 20% to the sell price. There are no property taxes on the Dutch side, but there are property taxes on the French side.

8. Be patient! Stay cool mon!

Cultural differences and government bureaucracy can turn your search for a dream property into a long and drawn out process. It is important that you be patient, keep in constant contact with your attorney and real estate agent to be sure that things are proceeding according to plan. Island time is a real thing, and the reason we all want to come here – to be on that clock. And yes, it is always five o’clock somewhere!

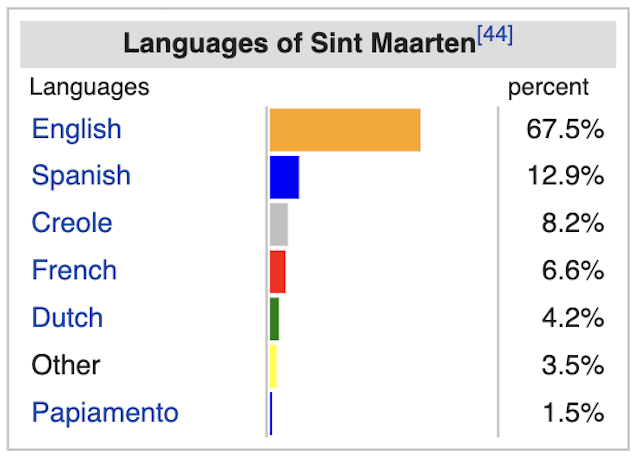

9. Learn about the foreign exchange rate

Exchange rates vary in the Caribbean, and as such you will find many properties priced in US Dollars, British Pounds or Euro (as on the French side of St. Martin). On the Dutch side of St. Maarten the currency is Guilders but USD is used more often and can be used in real estate transactions. To make it easier on you when coming from countries with lower currency value, do not think about the exchange rate, use it to adjust your budget to reflect it.

10. Protect your new asset

After the purchase of your property is complete, be sure to include it in your existing will. If you do not yet have a will, now is the perfect time to get one. And check with your estate lawyer. To be safe, we have a Canadian will that covers Canadian laws and a Sint Maarten will that covers the laws here. We have seen USA wills contested because they do not follow St. Maarten Estate Laws. Have an estate lawyer read your wills carefully and with that in mind. Or, spend the kids inheritance so you don’t have to worry about it 🙂